GST CHANGES FROM 1 JULY 2023

In summary the changes are as follows:

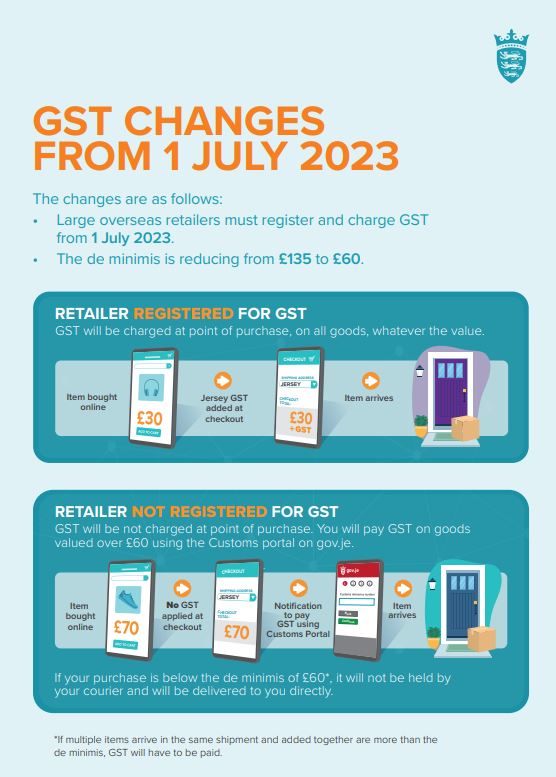

- Large overseas retailers must register and charge GST from 1 July 2023.

- The de minimis is reducing from £135 to £60.

Overseas retailers will charge GST at the point of purchase

From 1 July 2023 if you buy online or from a magazine or brochure, you will see 5% Jersey GST being charged at the point of purchase by a number of retailers that sell to Jersey customers. This will apply to all goods, including low value items.

The GST de minimis is being reduced

The de minimis remains as an administrative measure for goods that have had no GST charged at the point of purchase, but it is reducing from £135 to £60.

If you buy goods from an overseas retailer that doesn’t charge GST at the point of purchase, you will still need to pay GST to Customs before they are delivered, unless the de minimis amount applies.

Why is this changing?

We need to create a level playing field, as domestic retailers have always had to charge GST on all goods. The only reason there is a ‘low value’ threshold for online goods is purely for logistical reasons.

Since 2021 the European Union and the UK have required all goods that go across boundaries to be charged at the VAT/GST rate of the receiving Member State. Jersey has always planned to quickly follow those changes.

We can now ensure that GST is charged at the point of purchase, removing the logistical burden from Customs and the shippers in most cases.

We expect that most goods arriving in Jersey after 1 July will have GST already added.